Beyond the Traditional 60/40 Allocation

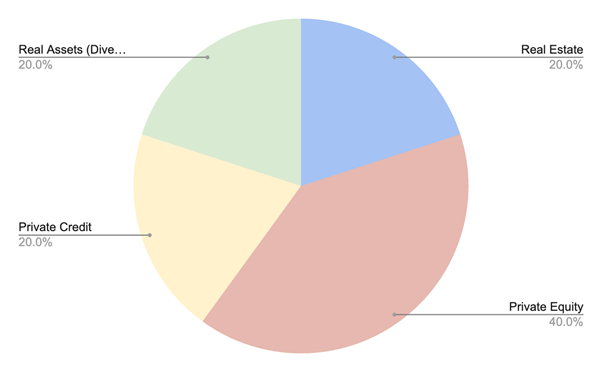

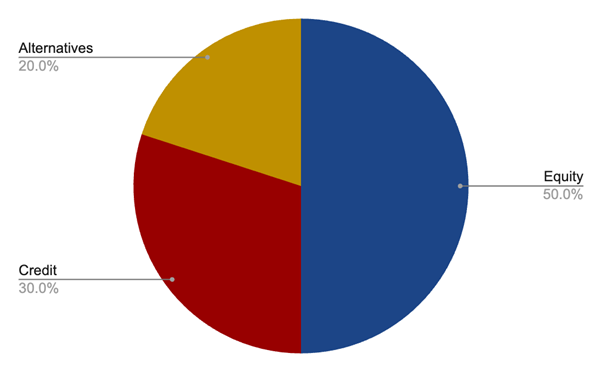

Institutional investors have increasingly moved beyond the conventional 60/40 portfolio allocation, recognizing the limitations of relying solely on equities and fixed income. The shift toward alternatives has accelerated, with these allocations gradually displacing portions of traditional asset classes. Leading asset managers, such as BlackRock, have even introduced new models like the 50/30/20 framework, where at least 20% is dedicated to alternative assets. Depending on the investor profile, some institutions and family offices now allocate over 50% of their portfolios to alternatives, underscoring the growing demand for non-traditional exposures.

Whiskey barrels present a compelling addition to this evolving investment landscape. As a real asset with intrinsic value growth, whiskey provides strong uncorrelated exposure to traditional asset classes and further diversifies an alternative allocation. Its lower risk profile—reinforced by the combination of steady global demand, intrinsic appreciation over time, and insurance coverage throughout the maturation period—positions it as a resilient complement to tangible assets. Furthermore, whiskey investments can serve as a hedge against the cyclicality of real estate and mitigate risks associated with private equity investments.

Within the widely adopted 50/30/20 model, whiskey barrels can enhance diversification and contribute to alpha generation alongside private equity, real estate, commodities, and other alternative asset classes. By integrating whiskey into an institutional portfolio, investors can benefit from a unique, time-tested asset with historically strong returns and low correlation to broader market cycles.

Where Does Whiskey Fit into an Institutional Portfolio?

The expanding universe of real asset opportunities justifies dedicated allocations within alternative investment sleeves. Whiskey barrels offer historically low correlation to the market cyclicality that affects major exposures such as real estate while presenting lower capital and market risk than private equity and venture capital. While whiskey shares some characteristics with commodities, its maturation process transforms new-fill distillate into a finished good, mitigating the volatility typically associated with pure commodity investments. Given its intrinsic value appreciation over time, whiskey warrants consideration as a distinct real asset allocation within institutional portfolios, offering both diversification and downside resilience.